How Much my Home is Worth? The place where you can trust our experience and expertise to get the answers you need. How much is my home worth?

What Is an Assumable Loan?

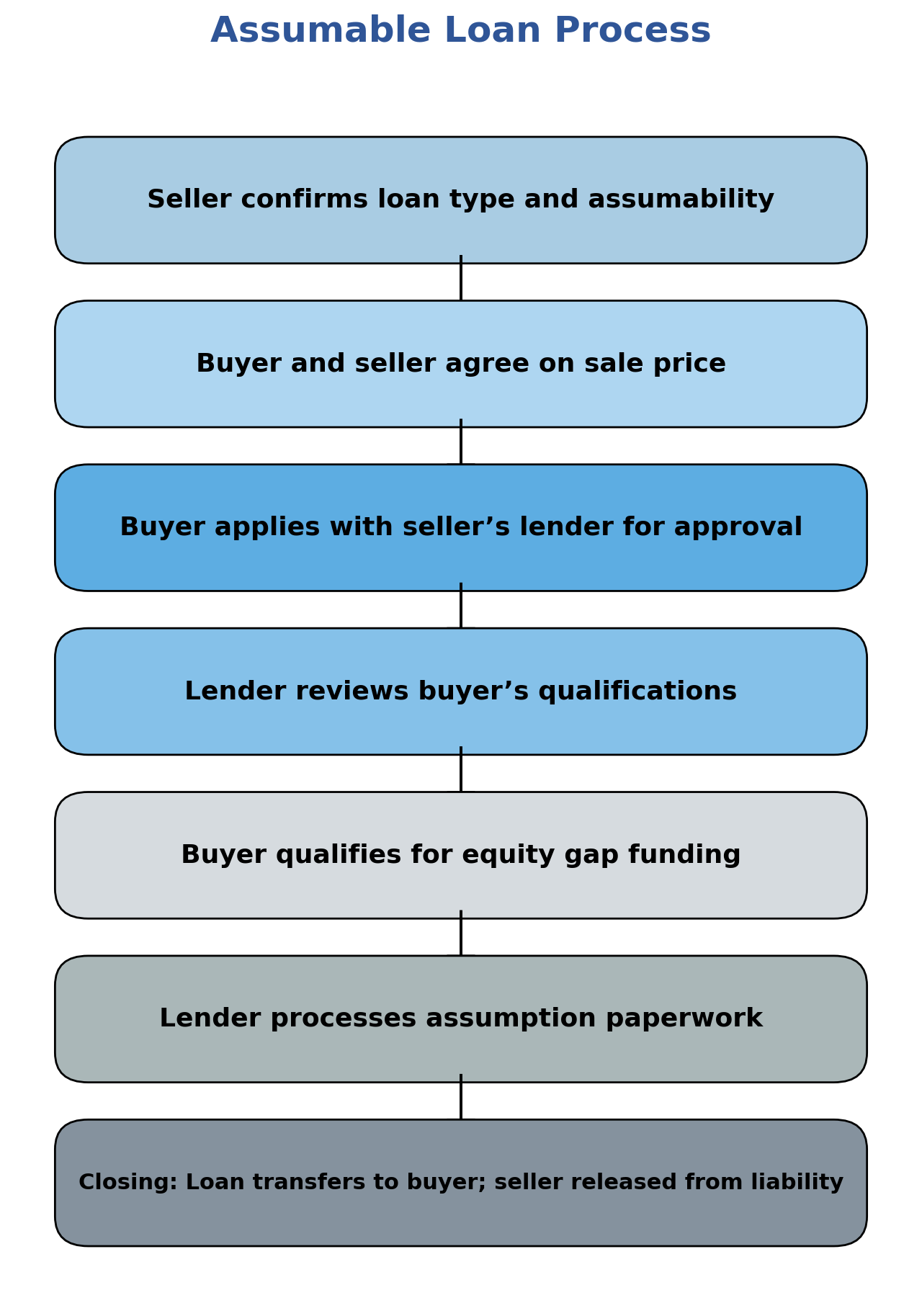

An assumable loan means a buyer can take over your existing mortgage, including the rate, balance, and terms, instead of getting a brand-new loan. If your interest rate is lower than today’s market rate, this could make your home more attractive to buyers.

Why They are Attractive to Buyers

- Lower interest rate than the current market rates

- Lower monthly payment potential

- Fewer closing costs compared to a new mortgage

- Appraisals/reports may be waived, saving money

- Can make your listing stand out against other homes

How to Know if Your Loan is Assumable

| Loan Type | Assumable? | Notes |

| FHA | ✅ Yes | Buyer must qualify with the lender; small assumption fee |

| VA | ✅ Yes | Buyer must qualify; seller’s entitlement may stay tied up unless buyer is VA-eligible |

| USDA | ✅ Yes | Qualification required: rural property loans |

| Conventional | ❌ Generally No | Most have a “due-on-sale” clause |

| Private/Seller-Financed | ✅ Possible | Depends on the note/deed of trust terms |

Challenges & Considerations

- Equity gap: Buyers may need a large down payment or secondary financing

- Lender processing time: Can take longer than a traditional sale

- Qualification: Buyers must meet the lender’s credit/income requirements

- VA entitlement: Sellers may lose the ability to use the VA benefit until the entitlement is restored

- Buyer must be buying primary residence

- No corporations, trusts; has to close in individual’s name.

Is My Loan Assumable? Here’s What To Check:

1. Check Your Loan Documents

Look at your Promissory Note and Deed of Trust or Mortgage. Search for:

- Assumption Clause

- Due-on-Sale

2. Call Your Loan Servicer. Ask:

“Can you confirm whether my loan is assumable and, if so, what the process and fees will be?” The phone number is on your monthly mortgage statement.

Thinking of Selling?

If you want to know whether your loan is assumable and how it could help you sell for more, reach out today. I’ll help check your loan type and guide you through the process.

Want to work with us? Here are some ways to get involved.

-

Search the entire MLS for your Central Coast home. Looking for a home on the Central Coast?

-

I’ll help you find the best local loan officer to get you competitive rates and the programs that best fit your individual needs. The Home Loan Process